Printable Tax Deduction Cheat Sheet

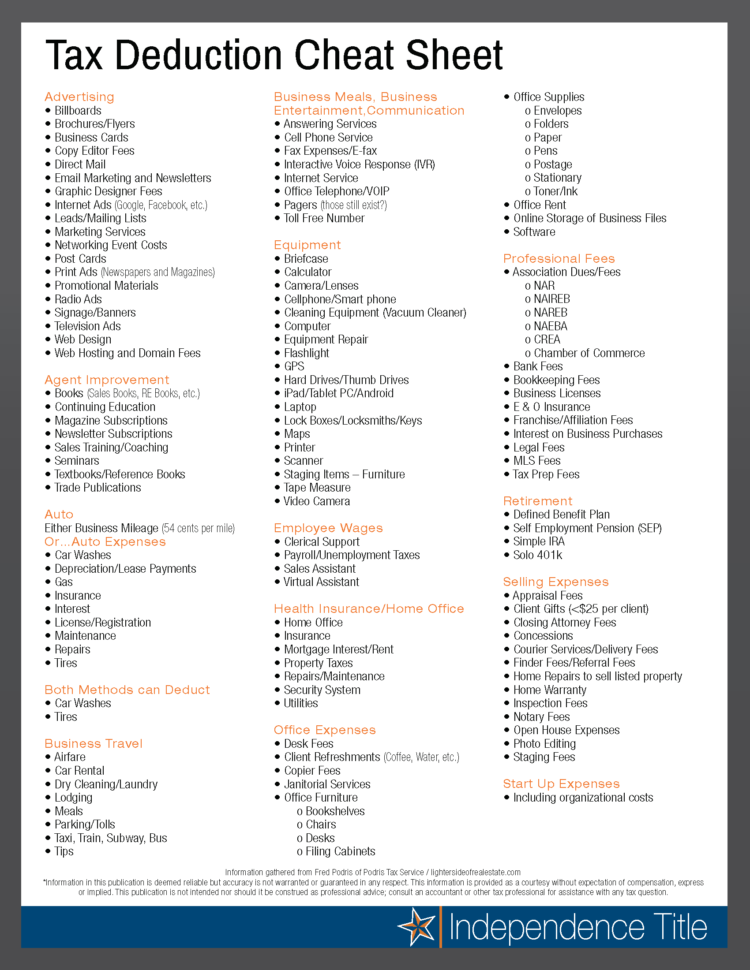

Printable Tax Deduction Cheat Sheet - 2024 edition cheat sheet is here to help guide you through tax challenges with some straightforward strategies. Click the links below to find details on the different tax deductions you can take depending on your unique setup. Web let’s break down these distinctions: Web our small business tax deduction cheat sheet makes it simple. In 2022, business meals were 100% deductible when conducting business meetings at a restaurant with employees. Web such a cheat sheet is exactly what’s below, thanks to two folks: Web use this self employed tax deduction cheat sheet to help you pull together an accurate tax return that minimizes what you might owe the irs. Don’t forget to grab your downloadable and printable tax deduction cheat sheet here: Love them or hate them (okay, no one loves paying them!), everyone has to deal with them. Web for the 2022 year, you can deduct 100% of business meals when talking shop with employees, but keep your receipts. Web taxes for dummies. Please always confirm all deductions with your c. If your startup costs are more than $50,000 in year one, your deduction will be reduced by the amount above the limit that you paid. There are several types of deductions that business owners can leverage for their taxes. Working through the list together will give you the. The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. Web if you are paying for 2022 standard deduction, it applies as follows: Let’s say you drive 1,200 business miles this year. According to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3%. The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. Web if you are paying for 2022 standard deduction, it applies as follows: Explore book buy on amazon. In fact, if you work from home like i do, there is no doubt that you enjoy your extra short. There are several types. Web such a cheat sheet is exactly what’s below, thanks to two folks: The result is your tax deduction. After the first year, you can amortize the remaining expenses over the next 15 years. Choose the option that gives you a better tax return. Just check off the items as you validate them with your records, or for those you’re. 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. In fact, if you work from home like i do, there is no doubt that you enjoy your extra short. Web the percentage of that $45,000 income that is taxed depends on your business’s. Advertising and marketing costs are 100% deductible. After the first year, you can amortize the remaining expenses over the next 15 years. The 2023 tax deduction cheat sheet for business owners. Web if your costs are $50,000 or less in the first year, your deduction is capped at $5,000. Web let’s break down these distinctions: 2024 edition cheat sheet is here to help guide you through tax challenges with some straightforward strategies. Working through the list together will give you the best opportunity to save. Web let’s break down these distinctions: Web for the 2022 year, you can deduct 100% of business meals when talking shop with employees, but keep your receipts. Assuming your effective. Have documentation for your deductions and. Taxes are a part of life. $25,900 for surviving spouses or married couples who are filing jointly. 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. If your startup costs are more than $50,000 in year one,. Choose the option that gives you a better tax return. In 2022, business meals were 100% deductible when conducting business meetings at a restaurant with employees. Web use this self employed tax deduction cheat sheet to help you pull together an accurate tax return that minimizes what you might owe the irs. Web for 2024, the rate is 67 cents. Advertising —> deduct it using: Please always confirm all deductions with your c. In fact, if you work from home like i do, there is no doubt that you enjoy your extra short. Don’t forget to grab your downloadable and printable tax deduction cheat sheet here: Working through the list together will give you the best opportunity to save. Assuming your effective tax rate is 20%, that $5,000 tax deduction. Web if your costs are $50,000 or less in the first year, your deduction is capped at $5,000. Taxes are a part of life. Click the links below to find details on the different tax deductions you can take depending on your unique setup. The 2023 tax deduction cheat sheet for business owners. Web for the 2022 year, you can deduct 100% of business meals when talking shop with employees, but keep your receipts. Despite the cap, many freelancers find value in the simplified method. The simplified method deducts $5 for every square foot of your home office space (up to 300 square feet). For 2023 (taxes filed in 2024), the credit ranges from $600 to $7,430, depending. $19,400 for heads of the household. Have the social security numbers and dates of birth for you, your spouse, and your dependents at hand before you start preparing your return. Web such a cheat sheet is exactly what’s below, thanks to two folks: Remember to report all income, including state and local income tax refunds, unemployment benefits, taxable alimony, and gambling winnings. Web let’s break down these distinctions: There are several types of deductions that business owners can leverage for their taxes. Love them or hate them (okay, no one loves paying them!), everyone has to deal with them.

StartUp CheatSheet 10 Tax Deductions You Must Know — Pioneer

Printable Tax Deduction Cheat Sheet

Tax Deduction Cheat Sheet For Real Estate Agents —

Printable Tax Deduction Cheat Sheet

Business Tax Deductions Cheat Sheet Excel in Grey Deductible Tax Write

Printable Tax Deduction Cheat Sheet

The Epic Cheatsheet to Deductions for the SelfEmployed Small

Printable Tax Deduction Cheat Sheet

Printable Tax Deduction Cheat Sheet

Printable Tax Deduction Cheat Sheet

Advertising And Marketing Costs Are 100% Deductible.

If You’re Eligible For A $2,000 Tax Credit, That’s $2,000 Less You Owe To The Government.

After The First Year, You Can Amortize The Remaining Expenses Over The Next 15 Years.

The Result Is Your Tax Deduction.

Related Post: