Free Printable Tax Deduction Worksheet

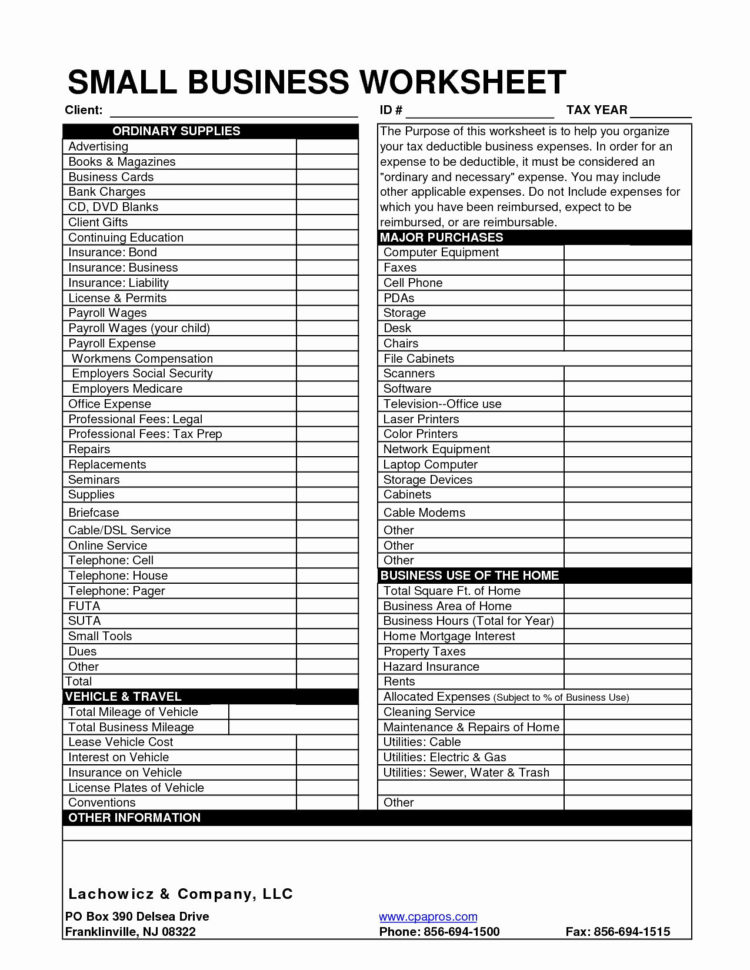

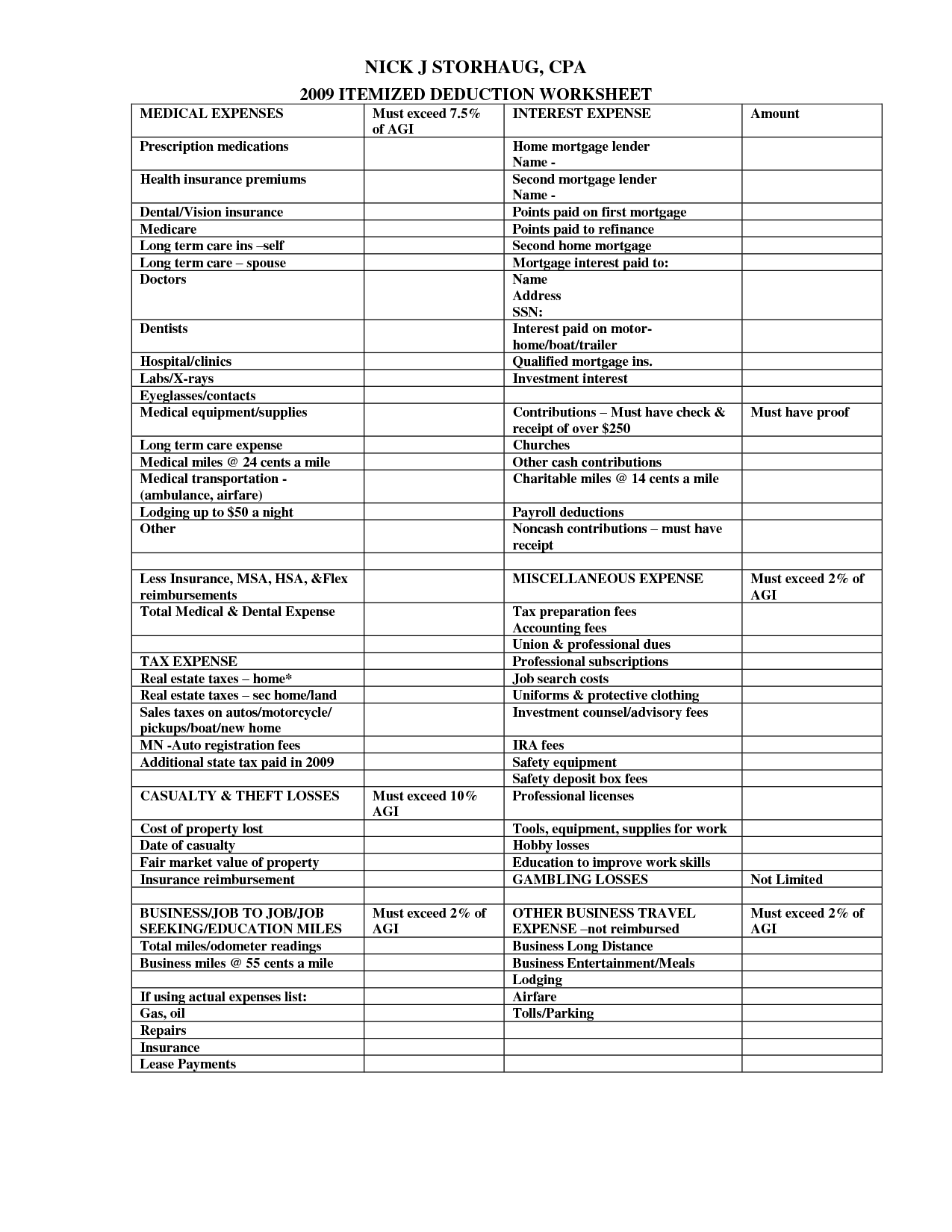

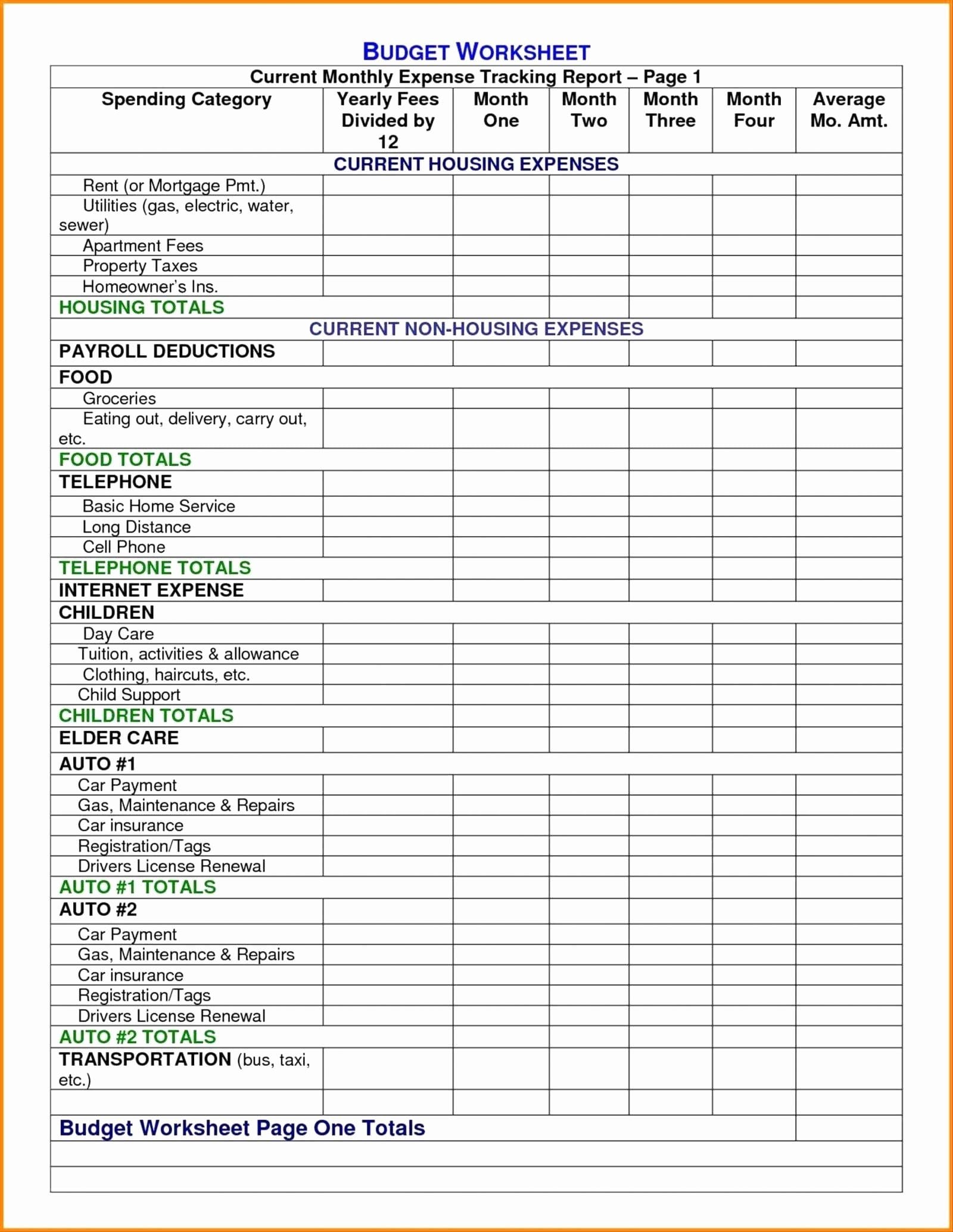

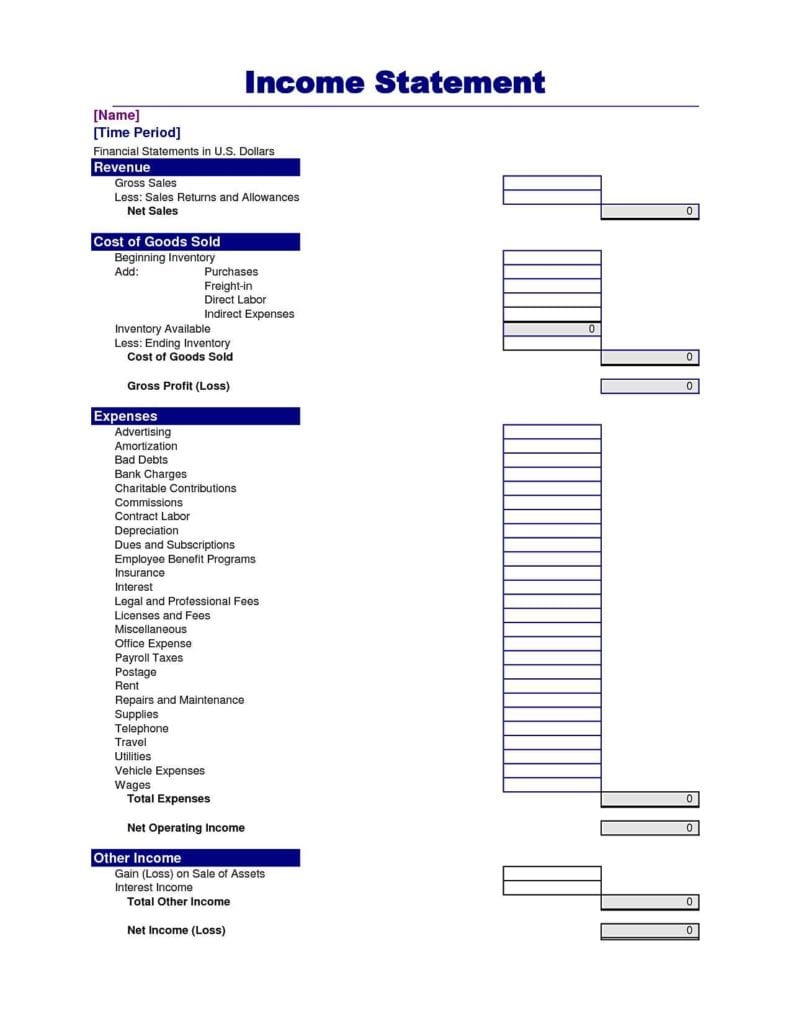

Free Printable Tax Deduction Worksheet - Federal section>deductions>itemized deductions>medical and dental expenses. Web depreciation deductions begin when property is ready and available for rent. At casey moss tax, we have a free spreadsheet template that you can use to organize all. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. The source information used is. Easily sign the form with your finger. Mod boutique agency's monthly expense tracker. Whether you’re a small business owner, a solo entrepreneur, or a freelancer, understanding tax deductions is an essential skill. Remember, you'll need proof of your deductions. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Web itemized deductions worksheet you will need: Mod boutique agency's monthly expense. Web the attached worksheets cover income, deductions, and credits, and will help in the preparation of your tax return by focusing attention on your special needs. The worksheet can help real estate. Web get our free printable small business tax deduction worksheet. Web track and calculate your home office expenses with this free template. Web unemployment tax (futa), state unemployment. Web best 5 free tax expense spreadsheets. Remember, you'll need proof of your deductions. Web utilizing a real estate agent tax deductions worksheet can be an efficient way to manage and organize deductible expenses. We have created over 25. Open form follow the instructions. Web depreciation deductions begin when property is ready and available for rent. Federal section>deductions>itemized deductions>medical and dental expenses. The source information used is. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web track and calculate your home office expenses with this free template. Web we’ll use your 2023 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,850 or $1,500 if married): Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). Mod boutique agency's monthly expense tracker. Web best 5 free tax expense spreadsheets. Easily sign the form with your finger. Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Find worksheets for wages, interest, rental, expat, home, and more. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web depreciation deductions begin when property is ready and available for rent. Easily sign the form with. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. The worksheet can help real estate. Web best 5 free tax expense spreadsheets. Web the purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. Find worksheets for. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. The irs does not allow a deduction for undocumented mileage. In order for an expense to be deductible, it must be considered an ordinary. Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). Keeper tax office deduction template. Web get printable yearly itemized tax deduction worksheet. Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. The source information used is. At casey moss tax, we have a free spreadsheet template that you can use to organize all. Tax information documents (receipts, statements, invoices, vouchers) for your own records. Web best 5 free tax expense spreadsheets. The worksheet can help real estate. Find worksheets for wages, interest, rental, expat, home, and more. Web tax worksheets & logs. We have created over 25. Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Web itemized deductions worksheet you will need: At casey moss tax, we have a free spreadsheet template that you can use to organize all. Remember, you'll need proof of your deductions. If too little is withheld, you will generally owe tax when. Keeper tax office deduction template. The irs does not allow a deduction for undocumented mileage. The worksheet can help real estate. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. If there are multiple vehicles, please attach a separate statement with a breakdown per. Find worksheets for wages, interest, rental, expat, home, and more. Easily sign the form with your finger. Web download free pdf worksheets to organize your income tax data by topic, occupation, or year. Web unemployment tax (futa), state unemployment (sui) and state training tax (ett). Web depreciation deductions begin when property is ready and available for rent. Tax information documents (receipts, statements, invoices, vouchers) for your own records.

Free Printable Tax Deduction Worksheets

Printable Tax Deduction Worksheet —

12 Best Images of Tax Deduction Worksheet 2014 Tax Itemized Deduction

Printable Yearly Itemized Tax Deduction Worksheet Fill and Sign

Tax Deduction Worksheet FREE Printable Worksheets Awesome Tax

Printable Self Employed Tax Deductions Worksheet Studying Worksheets

Printable Tax Deduction Worksheet —

federal tax deduction worksheet page —

Free Printable Tax Deduction Worksheet Printable Word Searches

Free Printable Tax Deduction Worksheet

The Source Information Used Is.

Whether You’re A Small Business Owner, A Solo Entrepreneur, Or A Freelancer, Understanding Tax Deductions Is An Essential Skill.

Web We’ll Use Your 2022 Federal Standard Deduction Shown Below If More Than Your Itemized Deductions Above (If Blind, Add $1,750 Or $1,400 If Married):

In Order For An Expense To Be Deductible, It Must Be Considered An Ordinary.

Related Post: