Debt Payment Plan Printable

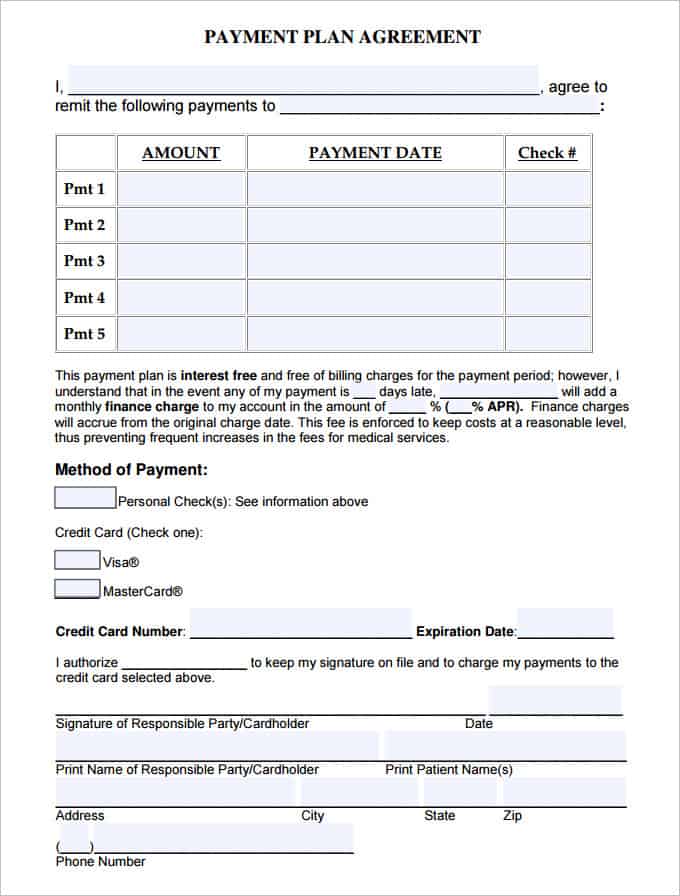

Debt Payment Plan Printable - Web freezers in 10 stores across the country have been changed, taking into account supply routes and the weather, with plans to roll out the temperature change to. Web however, this isn’t a payment plan and doesn’t offer any financial relief for those who are struggling to pay their tax debt. If you have outstanding debt (and who doesn’t?), then. Put any extra dollar amount into your smallest debt until it is paid off. List all the debts you have. Track your progress and monitor your credit report. On the left you write in the names of all your different debt sources, like “credit cardx”, “car loan”, “student loan. Web developing a debt payment schedule template can help you manage your debt repayment. Web work together in the budgeting process so you're both informed and on board. It shows you the list of your debts. It shows you the list of your debts. Web this debt amortization calculator will show you just how much money you could be saving by increasing your payments on a particular debt. Once you’re organized, it’s time to decide two important things about your debt repayment plan: By having a structured plan, it is easier to keep up with payments,.. List all the debts you have. Web with this payment plan template, you can state your payment plan’s specifics and ensure thorough understanding and agreement from everyone involved. A debts snowball payments sheet to record your debt payments, and a debt payoff visual that you. Form search engine30 day free trialedit on any devicefree mobile app Web use this debt. Web this free printable debt snowball worksheet is pretty easy to use. Web work together in the budgeting process so you're both informed and on board. Look through the pros and cons. By having a structured plan, it is easier to keep up with payments,. Web this debt planner will allow you to see the big picture of what your. Use it as a guide or fill. There are two basic strategies to reduce your debt: Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Web developing a debt payment schedule template can help you manage your debt repayment. Web however, this isn’t a payment plan and doesn’t offer any financial relief. A debts snowball payments sheet to record your debt payments, and a debt payoff visual that you. It shows you the list of your debts. Do the same for the second. Web a debt payment plan agreement is for any person or company that owes an amount of money that they cannot afford to pay immediately or under its current. Your “hit list” should consist of all your credit cards. There are two basic strategies to reduce your debt: It contains tables for each date,. If you have outstanding debt (and who doesn’t?), then. Do the same for the second. Your “hit list” should consist of all your credit cards. Once you’re organized, it’s time to decide two important things about your debt repayment plan: Web use this debt worksheet to see all your bills and plan what you owe. There are two basic strategies to reduce your debt: Web with this payment plan template, you can state your payment. Web work together in the budgeting process so you're both informed and on board. Web this debt planner will allow you to see the big picture of what your debt looks like and help you manage your finances better. The highest interest rate method and the snowball method. There is a debt priority worksheet to help you figure out which. Your “hit list” should consist of all your credit cards. There is a debt priority worksheet to help you figure out which debt to attack first. Web work together in the budgeting process so you're both informed and on board. How much you can afford to put towards your. Web developing a debt payment schedule template can help you manage. Web freezers in 10 stores across the country have been changed, taking into account supply routes and the weather, with plans to roll out the temperature change to. There are two basic strategies to reduce your debt: All pages are 100% free. Use it as a guide or fill. Track your progress and monitor your credit report. Web developing a debt payment schedule template can help you manage your debt repayment. Web freezers in 10 stores across the country have been changed, taking into account supply routes and the weather, with plans to roll out the temperature change to. Web use this debt worksheet to see all your bills and plan what you owe. Form search engine30 day free trialedit on any devicefree mobile app Use it as a guide or fill. The highest interest rate method and the snowball method. Your “hit list” should consist of all your credit cards. There are two basic strategies to reduce your debt: It shows you the list of your debts. Look through the pros and cons. Web however, this isn’t a payment plan and doesn’t offer any financial relief for those who are struggling to pay their tax debt. Do the same for the second. 2 fill out the table to see your total monthly debt payment. Web pay the minimum payment for all your debts except for the smallest one. It contains tables for each date,. Web with this payment plan template, you can state your payment plan’s specifics and ensure thorough understanding and agreement from everyone involved.

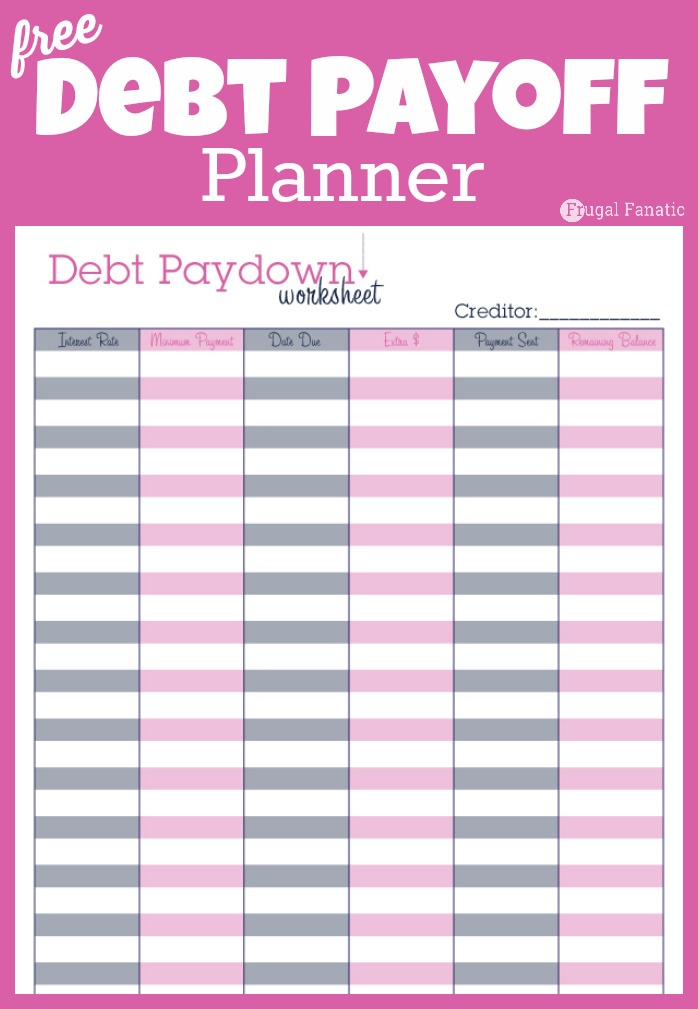

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Debt Payment Plan Printable That's Perfectly Fine As Well!Printable

Printable Debt Payoff Planner

Free Printable Debt Payoff Planner Web Grab The Free Printable Debt

FREE PRINTABLE! Use this Debt Repayment printable to pay down your debt

Debt Payment Plan Printable Paying off credit cards, Credit card debt

Debt Payoff Planner Free Printable

16+ Payment Plan Agreement Templates Word Excel Samples

Debt Payment Plan Budget Planner Printable Planner Debt Etsy

Web This Free Printable Debt Snowball Worksheet Is Pretty Easy To Use.

Web Use This Free Debt Repayment Plan Worksheet To Come Up With The Game Plan That's Going To Get You Out Of Debt.

All Pages Are 100% Free.

If You Have Outstanding Debt (And Who Doesn’t?), Then.

Related Post: